Challenges and needs

The client approached us with the following key issues:

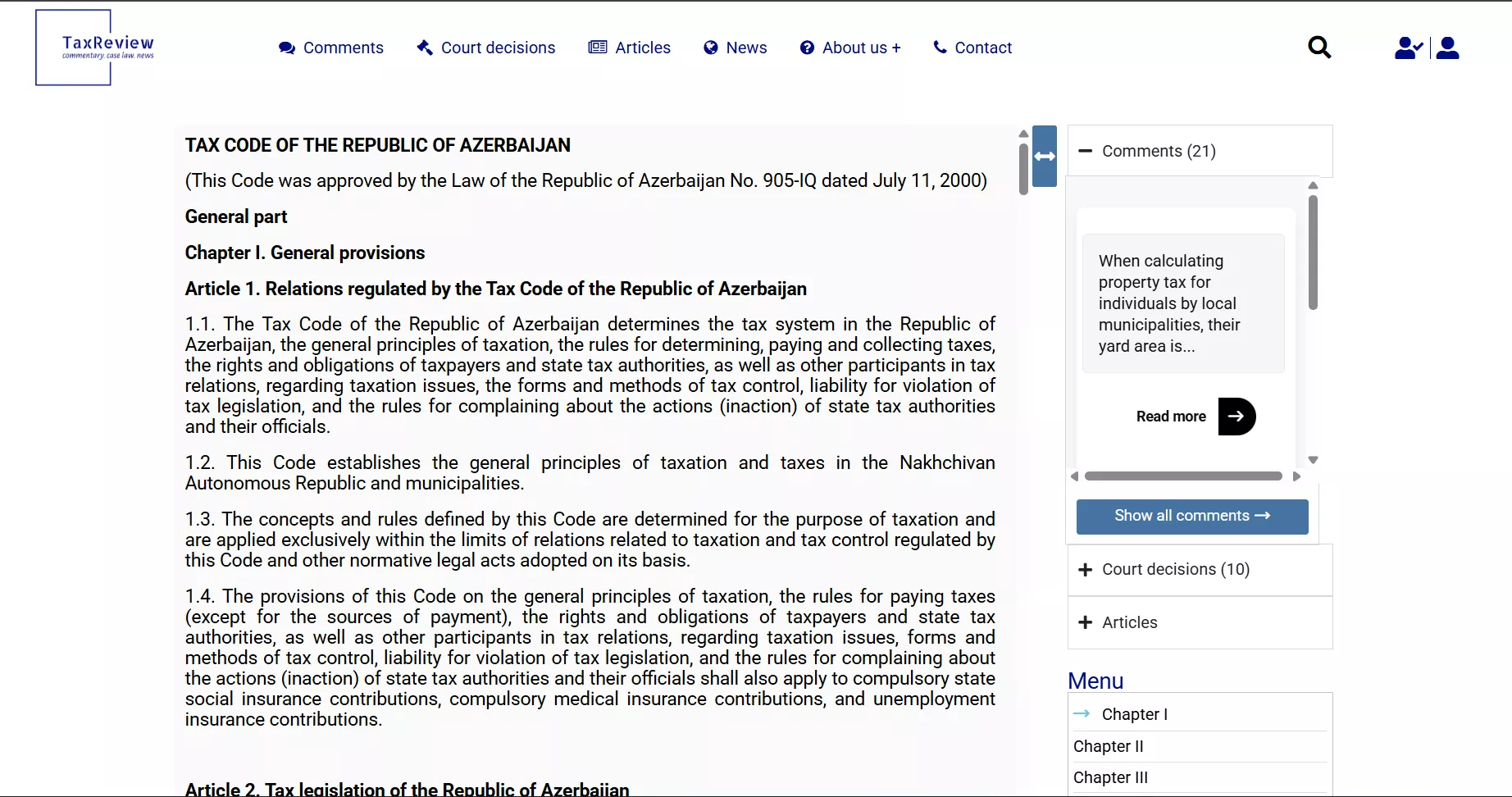

- Lack of centralized, searchable digital library — practitioners do not have a single, structured repository mapping official clarifications and court practice to Tax Code articles.

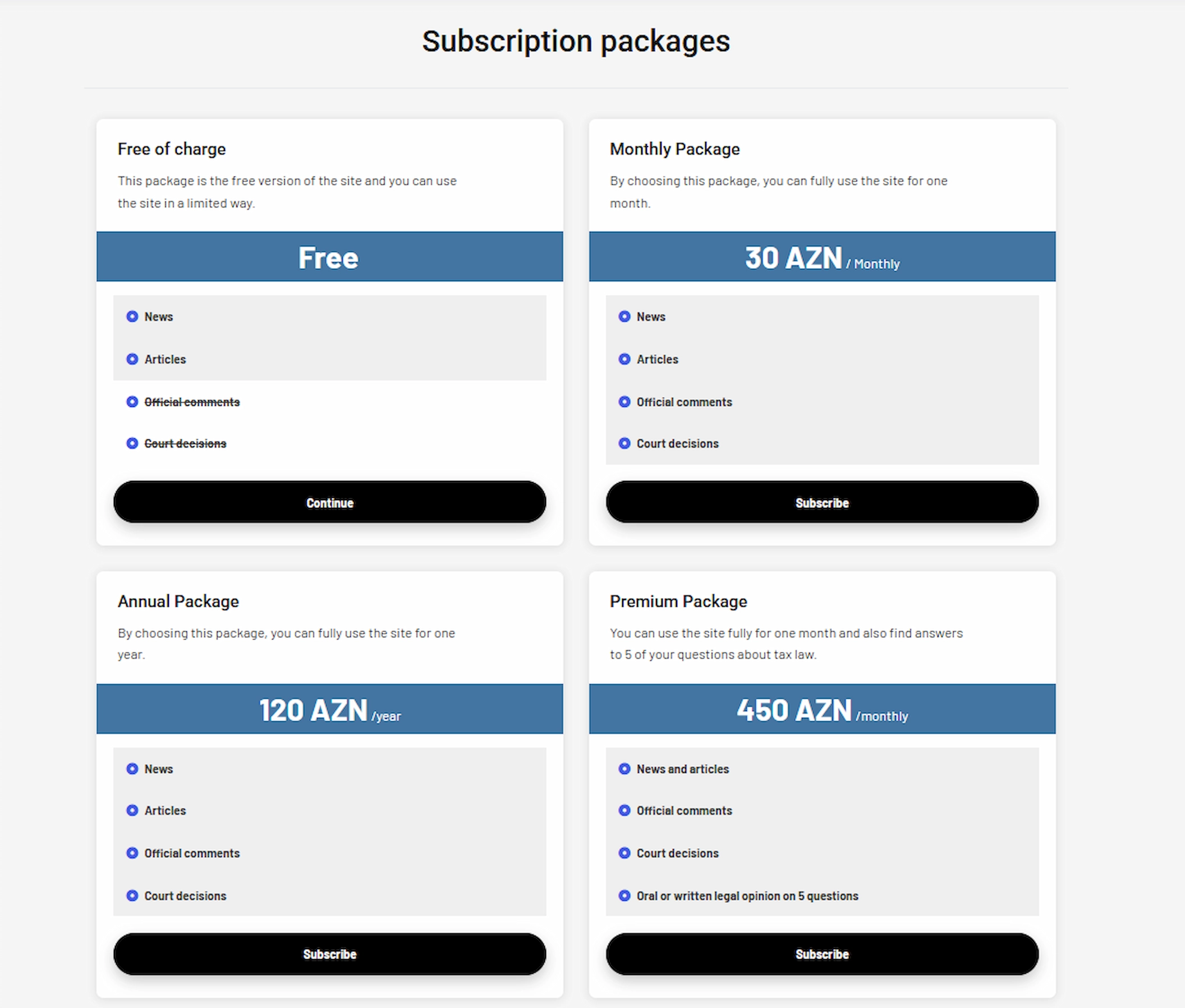

- Need in credibility and professional branding — the portal had to periodically signal authority (legal expertise) and trustworthiness to convert professionals into paid subscribers.

- Content access model — the platform aimed to have both free content to attract visitors and gated subscription tiers for monetization (paid access to official explanations and court practice).

- Clear content discovery & SEO — the goal is to let users be able to locate content by Tax Code chapter/article and by topic; Google visibility was important to capture research-oriented traffic.

- Mobile and desktop sensitivity — Local and global professionals must access content quickly from any device.

- Reliable contact / conversion traction — contact info, subscription flow, and secure payments needed to be prominent and structuralized.